Latest insights for the city centre - June 2023 quarter

A packed events calendar and people’s love for dining has delivered the strongest year-end results for Auckland's city centre in three years.

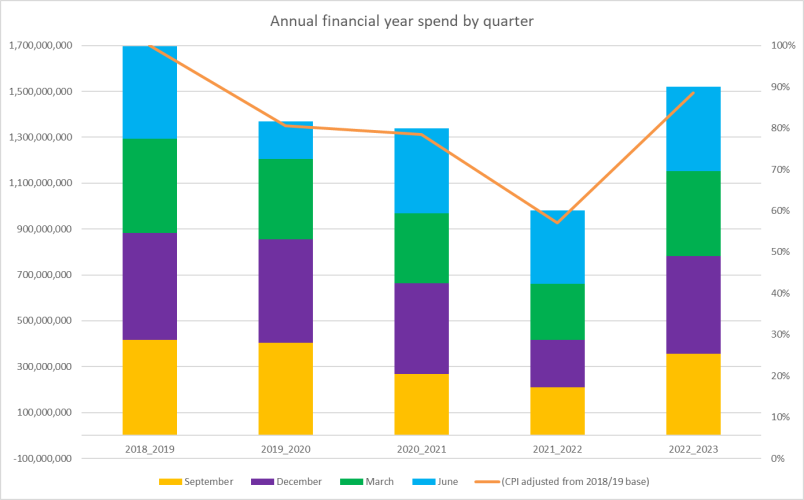

CPI-adjusted figures for the year- end June 2023 show spend was 89% of year end June 2019. While the June 2023 quarter was 91% of June 2019.

In real terms, the spending trend for 2023 is closer to 2019 values than it was in 2021 or 2022. We’re conscious that trading is still lumpy, but overall, this is good news that builds on the positive trends we saw emerging in the previous quarter.

Both local and international visitors loved our city centre’s dining offer during the quarter, with this category returning the biggest spend across the quarter for both sectors.

Events continued to be an important drawcard, and the June 2023 quarter had a full calendar - like the Auckland Arts Festival and seasons of both Hamilton: The Musical and Kinky Boots. The Auckland Writer's Festival programme was a great example of the impact of events here. Streetside Britomart (proudly sponsored by us) was a one-off event that had over 1600 attendees.

It was also fantastic to welcome a number of new businesses to the heart of the city throughout the quarter as well.

Download our June 2023 quarterly insights here.

Spend:

The June 2023 quarter results show spending in the Heart of the City has edged closer to pre-COVID levels (2019). Inflation-adjusted figures for the year-end July 2022-June 2023 were 89% of year-end June 2019 (or down 11%). (Graph and Image 1).

Night-time spending

Growing the night-time economy is a key opportunity for the city centre. For the June quarter, there was a 11% increase over the March quarter. The overall night-time spend (6 am – 6 pm) for the year ending June 2023 also returned to pre-COVID levels, with a value of $481m and 32% of overall spend. (Image 1).

Transactions

The overall number of transactions grew in the June quarter compared to the June 2022 quarter, with the average value declining over the same period.

Number of transactions (June 2023 quarter vs. June 2022 quarter)

•HOTC: +19%

•Competitors: +9

Average value of transactions (June quarter vs. June 2022 quarter)

•HOTC: -4%

•Competitors –6%

Who's spending from where and on what?

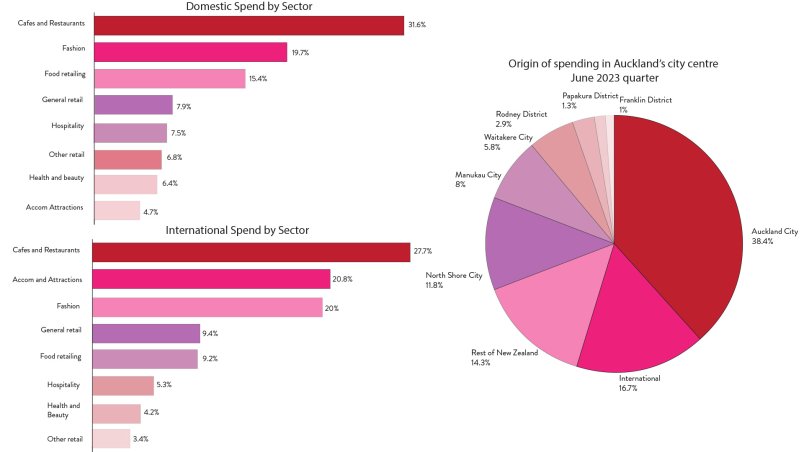

People residing in the Auckland City area (the old boundaries of the Auckland City Council) make up the biggest share of city centre spending (38%). (Graph 4).

International spending dropped in the June 2023 quarter compared to the previous quarter (16.7% vs. 27%), with the shift from the peak to the shoulder tourism season. (Graph 4).

Both Cafes and Restaurants and the Fashion categories had the biggest spends across both domestic and international sectors, with accommodation and attractions also pulling in international spending. (Graphs 2 and 3).

Pedestrian Counts

Foot traffic remains static

The number of people passing our pedestrian counters remains relatively static to the previous quarter, at around 70% of pre-COVID levels. (Graph 5 and Image 2). Friday and Saturday continue to be the busiest days for foot traffic in the city centre.

Accommodation Forward Bookings

Looking ahead

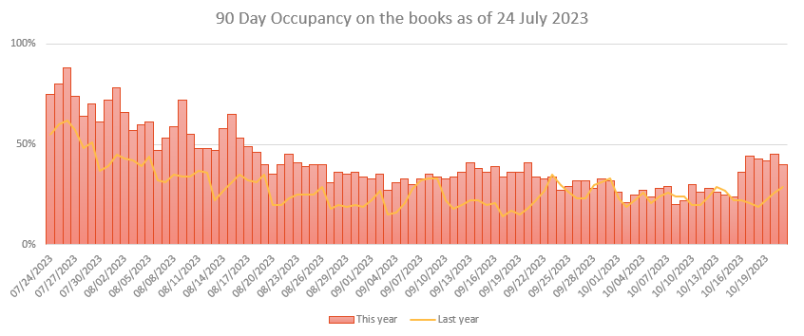

Events play an important role in driving up hotel occupancy. The full effect of the FIFA Women's World Cup™ will not be known until the conclusion of the tournament at the end of August. Despite concerns about a slow pick up for accommodation across NZ during the event, the first week of the FIFA Women's World Cup™ saw a pick up of occupancy rates at Auckland city centre hotels – showing the potential benefit of major events on visitation. (Graph 6).

Previous Insights:

March 2023 quarterly insights

December 2022 (quarterly insights)

December 2022 (month)

November 2022

October 2022 quarterly insights

August 2022

July 2022

Keep up to date with our other insights and statistics here.