December 2024 Quarterly Insights

Auckland CBD strip retail vacancy rates decreased for the sixth consecutive biannual survey (Colliers); three sold-out Coldplay gigs caused hotel rooms to be fully booked; and international spend more than doubled compared to the previous quarter. The December quarter had its bright spots in what has been a difficult 12 months nationwide.

Let’s take a closer look at the results.

Overall spend results reflect wider trends

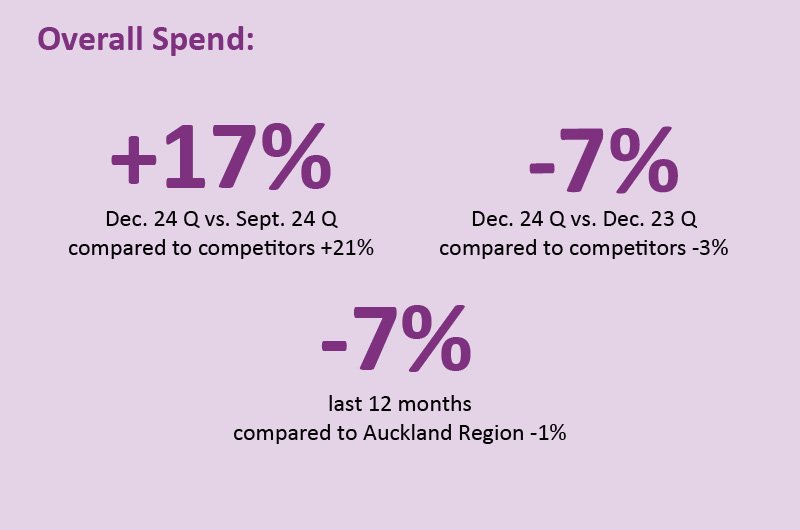

Helped by major international events, overall city centre spend in the December quarter was +17% over the September 2024 quarter, with competitors reporting +21% over the same period.

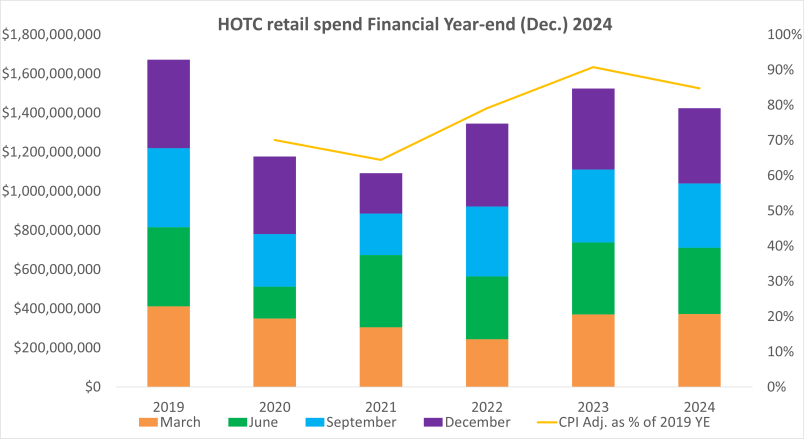

Unfortunately, this wasn’t enough to bring spending in the quarter above 2023 levels, still -7% compared to the December 2023 quarter.The overall year to date spend was at-7% vs. the prior year, and was 85% CPI adjusted of 2019. Year-to-date transactions were less impacted at - 0.4% year-on-year, showing the impact of the cost of living, with people simply spending less at the till.

Positively, the December quarter performed comparatively better year-on-year than the September quarter, which saw overall spend -12% vs. September 2023.

Looking at the months within the quarter, November performed the best. Out of the three months, it was the closest to 2023 (-3%) and was +19% over October. November was helped by increased visitation and resulting spend due to the Coldplay concerts held at Eden Park.

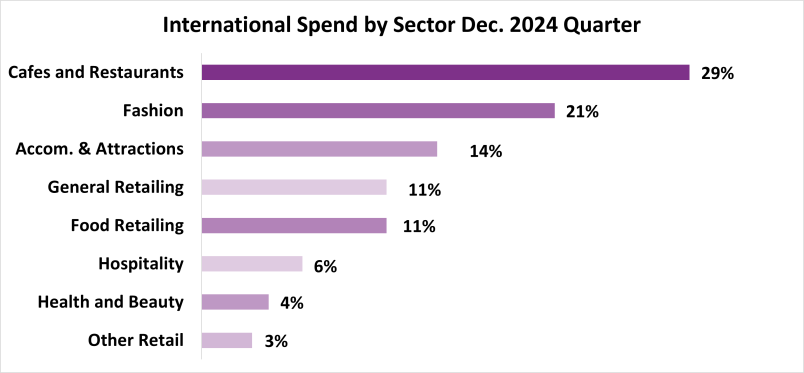

International spend is a bright spot; it more than doubled on the previous quarter and up on 2023

With the start of the peak tourist season, including cruise, overseas visitors left an impact during the quarter, with spend +55% on the September quarter and +2% vs. the December 2023 quarter.

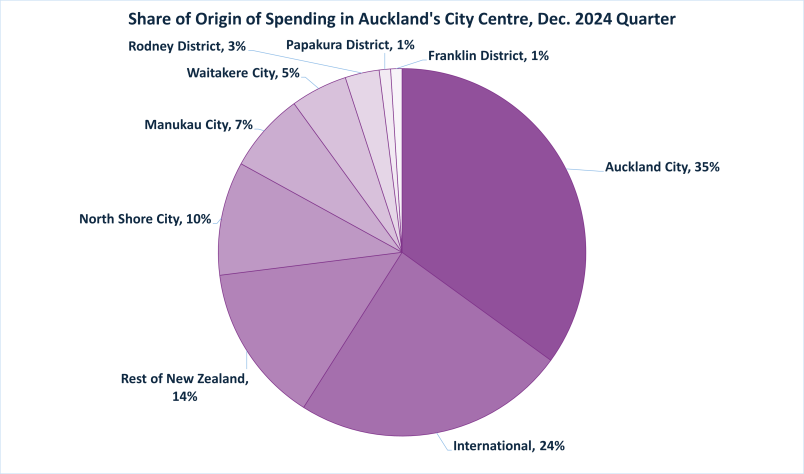

Unsurprisingly, the overall share of spend also shifted – with internationals making up 24% of all spending (up from 18% in the prior quarter), compared to 6% at our competitors.

Stats NZ reported that international visitor arrivals to New Zealand totalled 3.3 million in the December 2024 year, +12% from the December 2023 year. For the Auckland region, Tātaki Auckland Unlimited’s latest data on international arrivals reported to the year ending October 2024, shows that 2.2 million visitors touched down in the Auckland region,+13.9% on the previous year. The latest projections for international visitors show that 3.61 million people are anticipated to visit New Zealand in the year ending October 2028, with Auckland receiving the largest share.

Workers are in the office more often, busiest day to get a coffee revealed

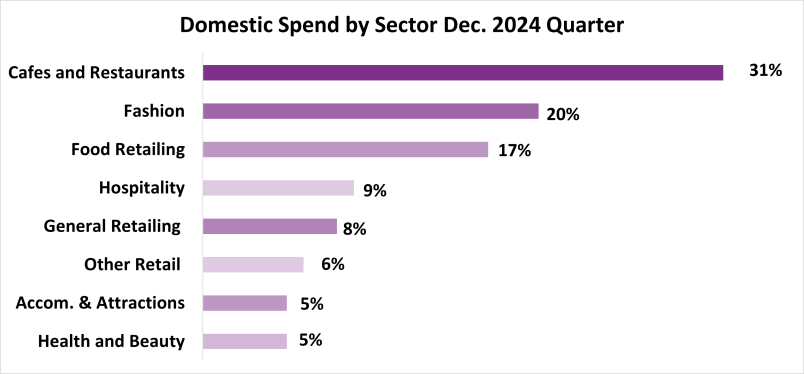

JLL’s Chris Dibble took a closer look at 22 of the city centre’s cafes and discovered that Thursdays between 11am – midday are the busiest time to grab a cup of coffee, closely followed by Wednesdays and Fridays.

The reason? Chris says it’s the return of workers, supported by his data showing that commuters have cafes buzzing between 7am – 9am. He’s not the only one reporting this. We’re hearing that a number of businesses now have their staff in the office four days a week, up from three.

Chris further elaborated on his findings in an interview with One Roof:

“The popularity of Thursday from 11am could be down to people going out for a mid-morning team or client meeting…after a few hours of working through your emails and what you need to do for the day it provides that sort of opportunity to catch up.”

Vibrant Diwali celebrations brought a two-day boost to foot traffic

Tātaki Auckland Unlimited reported that 60,264 people descended upon Aotea Square and its surroundings for the two days of Diwali festivities, spending a total of $1.96 million. Our foot traffic data showed the impact: Saturday 19 October +31% vs. the previous Saturday and Sunday 20 October +64% vs. the previous Sunday.

‘Paradise’ found: Coldplay concerts had out-of-towners flocking to the city centre

The back-to-back Pearl Jam and Coldplay concerts in November had a positive impact on the region. Out-of-towners flocked to attend both shows, making the hotels and attractions sector the big winners.

CBRE Hotels described the two weeks as “just what the market needed.” Combined, they drove 27,000 additional room nights and $19 million in additional hotel room revenue.

Occupancy peaked at 96% for Coldplay’s Friday concert. All three of their shows at Eden Park were sold out, with 57,000 at each gig.

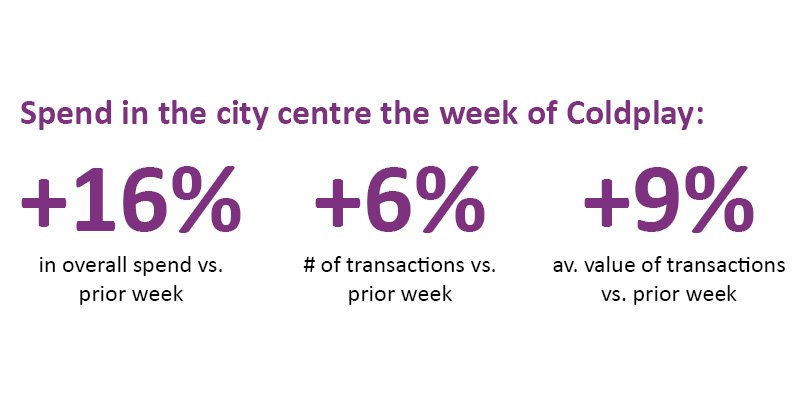

Let’s take a closer look at the impact Coldplay’s three shows in November had on the city centre.

These big numbers saw foot traffic here +19% on Wednesday, 13 November and +8% on Saturday, 16 November vs. the prior week.

We also saw spend from New Zealanders outside of Auckland +52% the week of the Coldplay shows compared to the previous week, with our hotels and attractions sector +45% vs. the prior week.

In terms of overall spend, Coldplay’s Saturday show generated the second-highest day of spend in the city centre for the month of November (Black Friday generated the most spend that month, ringing up $6.4 million).

A busy Christmas programme helped spread the festive cheer across the city centre, kicking off with the annual Farmers Santa Parade on Sunday, 24 November.

We also saw thousands of people attend the inaugural lighting of Te Manaaki, Auckland’s giant Christmas tree and a gift from Heart of the City and Precinct Properties, with support from Auckland Council via the city centre targeted rate. There was some great publicity around the event, including this wonderful interview by Kea Kids.

Corporate relocations, flight-to-quality shaped office leasing trends

Colliers reports that there is now a “new record level” of prime office space available in the city centre as major developments and refurbishments are completed. As a result, businesses are keen to upgrade their offices, resulting in “significant tenant movement”.

The combination of an increase in prime stock and tenancy movements has resulted in a rise in prime office vacancy rates: 9.8% for the second half of 2024 vs. 7.5% in June.

CBRE New Zealand’s executive director and research head Zoltan Moricz reported a similar trend in an interview with the New Zealand Herald.

He estimated that 7000 staff relocated within the city centre late last year, including Spark and Milford Asset Management and earmarked the completion of Manson TCLM’s Fifty Albert Street as having “a significant impact.”

“It shows demands by occupiers for new buildings,” said Zoltan. “The overall market demand has been resilient. But the size of the demand has not been large enough to offset those vacancies.”

More recently, Beca has opened its doors here, and One NZ is soon to return to Wynyard Quarter. Zuru will be coming to the city centre in February, moving 250 staff into 4000 sqm in Victoria Street West.

CBRE reports that their agents are “generally experiencing a busy start to the year.” Their latest occupier survey “indicates more favourable demand conditions for 2025.”

CBRE also notes that in 2025, there will be the largest increase in office space supply in 15 years, leading to higher vacancy rates. They “expect quite a rapid improvement during 2026 – 2028 driven both by positive demand as well as space withdrawals for alternative uses.”

Improvements to retail vacancy rates, new customer-facing businesses open

The latest Colliers vacancy rates for Auckland’s CBD strip retail sector is 9.9%. This is the sixth consecutive survey that vacancy has decreased, and the first time it has fallen below 10% since mid-2021. Overall, Colliers described occupation trends in 2024 as “positive.” With the City Rail Link expected to be operating in 2026, and the New Zealand International Convention Centre scheduled to be open in February of the same year, Colliers are optimistic about continued improvement for the retail sector.

Bayley’s has also indicated that positive changes in their commercial vacancy rates during the final quarter in 2024 points towards a positive 6 – 12 months for leasing.

An interview with Bayley’s Auckland general manager Scott Campbell in One Roof highlighted some of the changes driving his optimism in 2025, including the impact of the City Rail Link:

“As [the] project draws closer to completion, some office assets around train stations are being refurbished and repositioned to leverage the connectivity gains that the CRL will bring and retail/hospitality operators will also be looking to capture increased foot traffic.”

We’ve welcomed a number of new customer-facing businesses to the city centre recently: Our outdoor sporting offer has just got better with Mountain Warehouse’s arrival on Queen Street, Scrunchy Millers on Victoria Street West grows the extensive number of ice cream spots and Smokeland BBQ has opened in the Park Central food court on Albert Street which has seen good leasing.

There’s another jewellery business in the High Street District, with Lab-grown diamond experts Cullen Jewellery opening in the area, a stone’s throw from A Modo Mio, a quaint Italian eatery that’s boosted the outdoor dining experience on Vulcan Lane and luxury fashion designer Kiri Nathan in Britomart.

Hotel Indigo also soft-opened 54 of its 225 rooms during the December quarter. We can’t wait for the full opening early this year, which includes a fantastic French-inspired Bistro Saine in March, and a sophisticated cocktail bar and lounge to follow.

A summary of the December Quarterly Insights is available here.

Previous quarterly results are available here.