June 2024 Quarterly Insights: A tough quarter but stable vacancy rates, with green shoots on the horizon

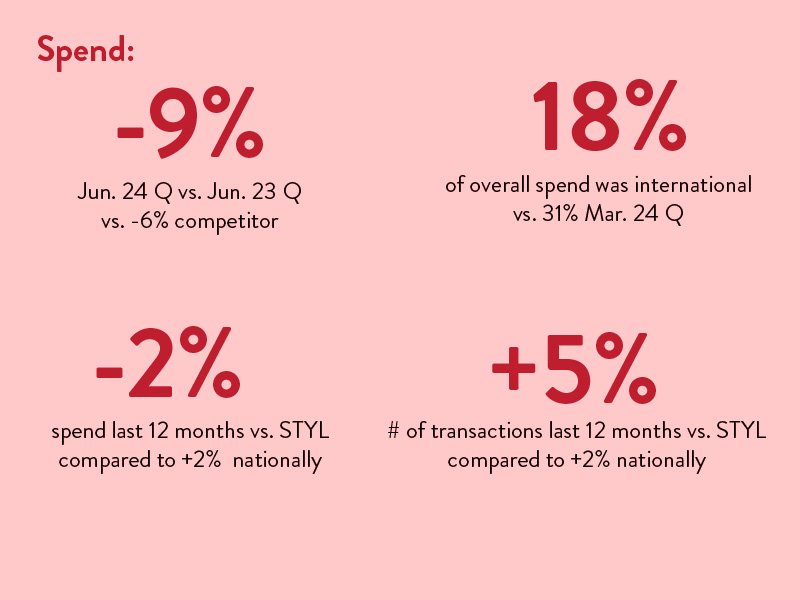

Off the back of a flat March quarter, the June quarter reflected the wider economic landscape, with both overall spend and foot traffic down compared to 2023 (Spend: -9% vs STLY, Foot Traffic: -7% vs STLY). This is consistent with retail trading generally seeing discretionary spending down and it was particularly evident in the month of June, which pulled down the overall results for the quarter (-13% STLY).

Whilst the March quarter saw the highest international spend in five years, it dropped back to ‘seasonal’ levels, meaning that an extra boost from the tourism dollar was not there this quarter to bridge the gap of overall reduced domestic spending.

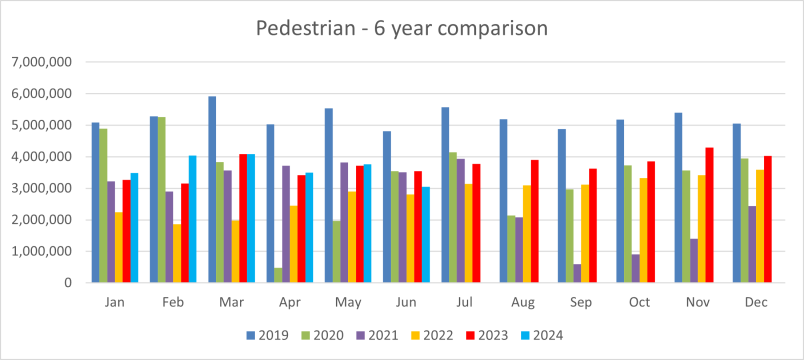

Whilst the quarter wasn’t easy, looking year on year, there has been +10% growth across our pedestrian counts (and +5% in the overall number of spend transactions), helped by the many events and activations to attract people here. Most recently this included New Zealand Music Month, the Auckland Comedy Festival and the Auckland Writer’s Festival with a record-breaking 85,000 attendees.

Given the challenging economic environment, it’s pleasing to see that both office and retail vacancies are “largely stable”, with demand remaining highest for premium, environmentally friendly spaces. There has also been some notable leasing news, including the planned return of One New Zealand to Wynyard Quarter in 2025.

Long term confidence remains with a number of major developments having been announced during the quarter including the planned refurbishment of the old McDonalds site on Queen Street, which also includes a new residential development. There’s also been a number of new businesses open, including SkyCity’s Horizon. Smith and Caughey’s announcement that they will be staying on Queen Street, and Sail GP in January is also fantastic news to share!

Overall spend:

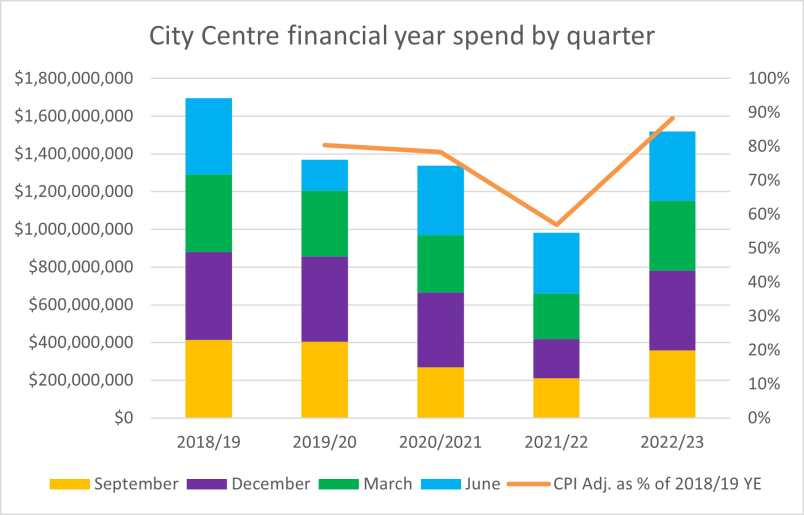

Overall, June year-end results sat at 88% of June 2019 (CPI adjusted). June Quarter spend was -9% compared to the June 2023 quarter (with competitors reporting -6%). Transactions were also -8%. A particularly difficult month of June (-13% vs STLY) contributed to the overall downturn this quarter.

We note that across the city centre there is variation of spending results, and there is displacement of spend towards the waterfront.

For the year ending June, spend was -2%, but there were more transactions year on year at +5%.

Who's spending and on what?

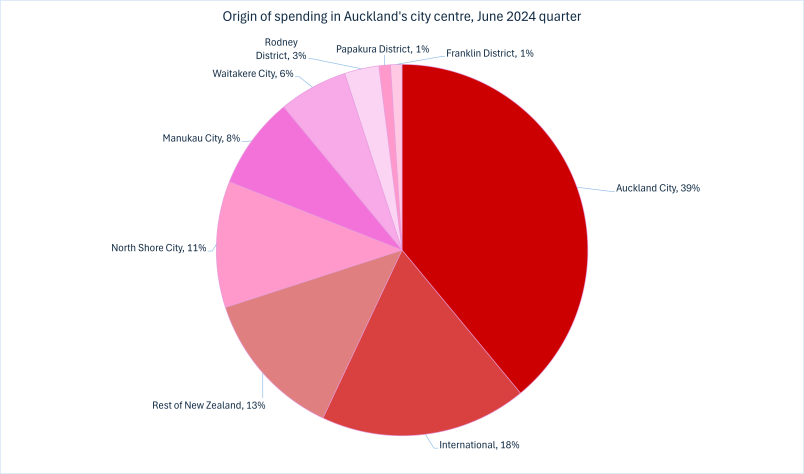

People residing in the Auckland City area (the old boundaries of the Auckland City Council) made up the biggest share of city centre spending (39%).

Cafes and Restaurants captured the biggest share across both domestic and international spend. This is unsurprising given the number of businesses that make up each category, with more than 750 cafes, restaurants, bars and takeaways available in the city centre.

International visitors didn't bridge the drop in domestic spending

Tourism spending dropped back to “seasonal” levels of overall spend in the quarter (18%), off the back of a five-year high in the March quarter. In that quarter, the extra boost from the tourism dollar was critical to offset reduced domestic spending, but as the numbers of tourists naturally dropped away out of the peak season, so too did overall spending.

Foot traffic:

Positively, foot traffic for the year-end June 2024, was up +10%, with the quarter down -7% vs STLY. This was pulled down by the quieter months of May (-9%)and June (-14%) vs STLY.

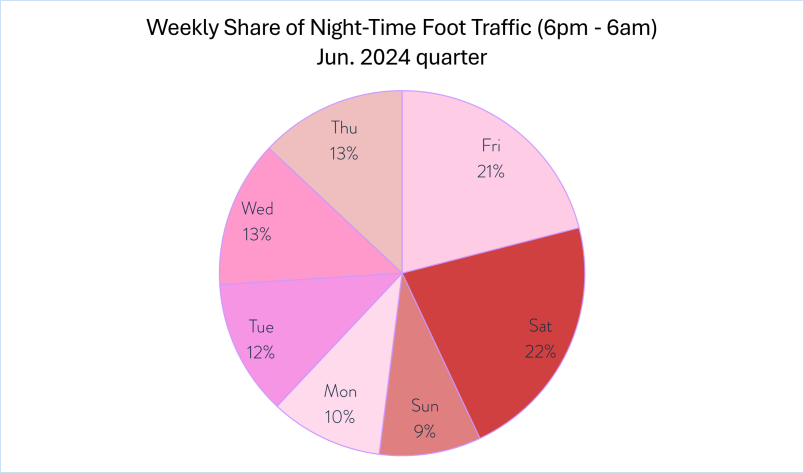

Overall, Saturdays were the busiest time to be in the city centre for the June Quarter

This is a shift from when we last reported on day/night trends for foot traffic (December 2023 quarter), where Fridays were the busiest time to be in the city centre.

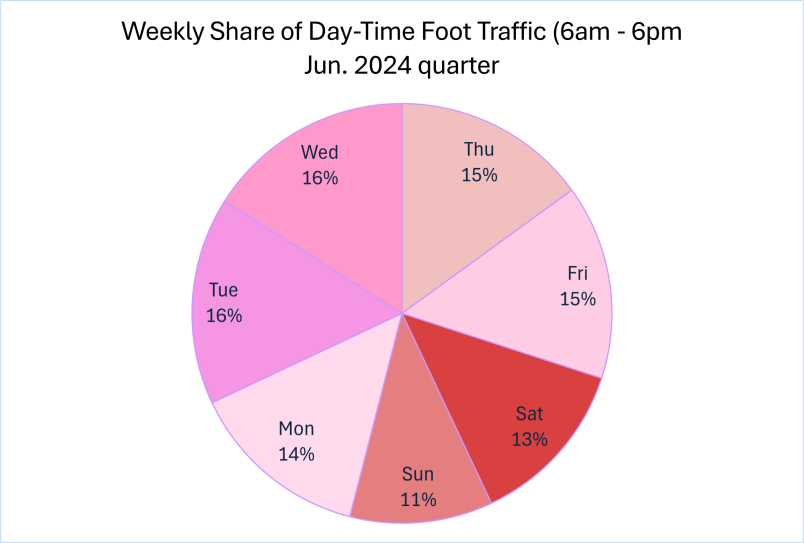

What were the busiest days (6 am – 6 pm) for the June quarter?

Midweek: Tuesday and Wednesday took out the top spot, generating 16% of all foot traffic across the week. Thursday and Friday followed (15% each), then Monday (14%). The weekends were the least busy daytimes - Saturday (13%) and Sunday (11%).

What were the busiest nights (6 pm - 6 am) for the June quarter?

As an entertainment district, Saturdays were the busiest night of the week, generating 22% of all foot traffic across the week, just marginally busier than Friday nights at 21%. Wednesday and Thursday nights made up 13% of foot traffic each, with Tuesday reaching 12%. Not surprisingly, Monday was 10% while Sunday was the quietest night of the week, making up 9%.

Leasing results:

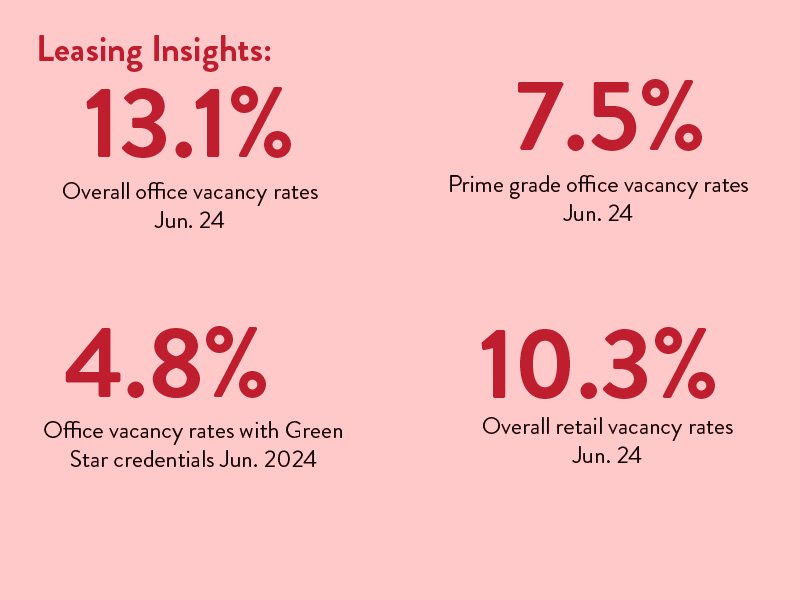

As of June 2024, office vacancy was 13.1%, slightly up from December 2023 (12.2%), and the trends remain unchanged from previous years as businesses “adapt to changes in workplace practices, employee and consumer preferences and an increased focus on sustainability.”

Premium office spaces continue to be in high demand, sitting at a 7.5% vacancy rate as of June 2024. Premium office spaces that have a Green Star rating are in particularly high demand and are at a 4.8% vacancy rate.

JLL’s New Zealand Market Dynamics Q 2 2024 describes the office leasing market as being “more active over the past quarter” noting the impact of the flight-to-quality trend.

“In contrast to the wider economic environment the development for Auckland city centre is strong and expected to continue to pull occupiers out of secondary properties. This is likely to further compound current secondary vacancy issues and suppress rental growth for these buildings.”

JLL has also noted an “increase in [retail] leasing demand” in the same area. They’ve recently leased a space within Precinct Property’s Commercial Bay to Austen & Blake. It will be the luxury diamond retailer’s first bricks-and-mortar store in New Zealand.

Despite the challenges faced by the retail sector, Colliers notes that “supports are also evident. The prospects for interest rate cuts in the short-term future is increasing as inflation slows, which will ease pressure on household budgets. Population growth, the return of overseas visitors and students and increasing numbers of workers returning to the [city centre] are also underpinning demand.”

New private development milestones, second-grade office buildings being given a new lease of life

With quintessential city centre adaptability and innovation, a number of second-grade office buildings have - or are – being transformed into hotels and apartments. Well-known examples include The QT, Intercontinental and The CAB. The latest to join their ranks is Urban Rest at 27 – 35 Victoria Street West, a former floor of offices has now been turned into a mixture of eight long-and-short-term apartments by developer Ben Wilson. Read more about this Anne Gibson's piece in the New Zealand Herald here.

In June, Precinct Properties announced their plans to build a 30-metre-tall tower with 500 student apartments on Lorne Street (as well as a commercial and retail refurbishment on the heritage building fronting onto Queen Street). Further student accommodation is currently under construction on the corner of Lorne and Rutland Street. 51 Albert Street, a development that includes The Hotel Indigo and 30 apartments, is set to open before the end of the year.

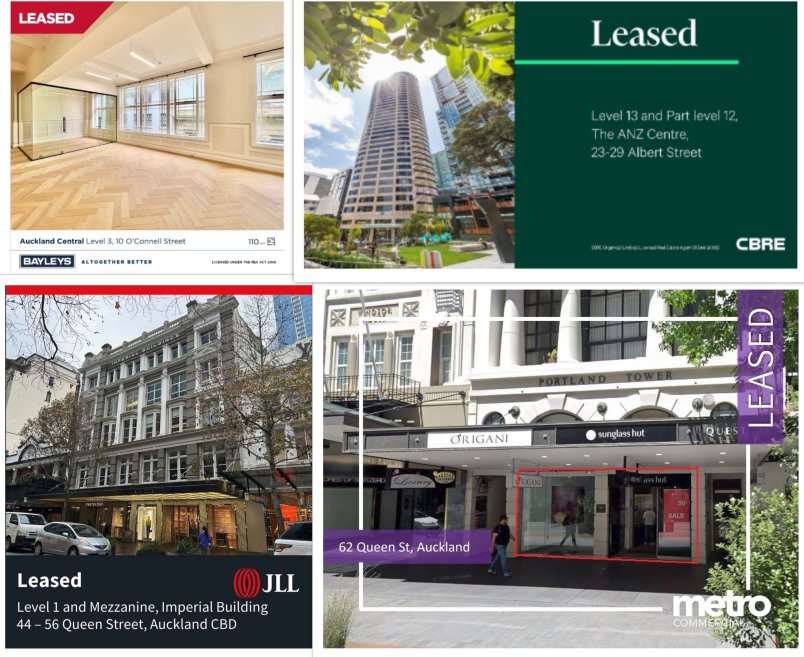

“Leased signs” in retail and commercial spaces across the city centre

Retail spaces around the Queen Street area have seen a flurry of activity. Here’s just a glance at what’s been happening overall:

JLL, secured SWAROVSKI to move across the road from 45 Queen Street, and its previous location has been snapped up by another luxury tenant (who will remain confidential for now), due to open in 2025. A hospitality and events company has taken over Level 1 & Mezzanine, Imperial Building, 44-56 Queen Street.

Metro Commercial Real Estate’s efforts mean that 62 Queen Street will be transforming into a flagship store for an international brand. There’s also been leasing activity in The Strand Arcade, following a programme of activation through the vacant spaces initiative, a partnership between Heart of the City and Auckland Council, with support from the city centre targeted rate.

Metro Commercial, having secured some recent spaces leased on Vulcan Lane, is also reporting a “continued uptick from smaller hospitality operators. Demand for space on southern High Street and on Lorne Street remains good, and Vulcan Lane is unquestionably one of the coolest urban architectural environments that Auckland has to offer.”,

Scarborough Group has leased 22 Durham Street West to Seoul Night, which is extending its offering in the city centre to include Hazy Tiger.

With strong commercial leasing for premium locations, One New Zealand announced that 1200 staff will move back to the city centre in 2025, with their new HQ occupying a Mansons TCLM development in Wynyard Quarter.

Other commercial leasing includes a number of spaces leased at The Vero Centre, the ANZ Centre and 48 Shortland Street.

Events bring the people

The Auckland Writers Festival in May had a record-breaking 85,000 attendees, which helped boost foot traffic in the city centre by +7% compared to the same time the previous week.

We’re looking forward to seeing the impact of “the Olympic games of singing” the World Choir Games, which brought more than 11,000 participants to Auckland, who both stayed and performed in the city centre, as well as our own Restaurant Month. The latter has had a fantastic start, with lots of events already booked out.

Looking to next summer, we were thrilled by the announcement that Auckland will host the SailGP regatta in January 2025. Major events are a vital part of attracting people into the city centre – and spending here. In an interview with Radio New Zealand, our Chief Executive Viv Beck said, "It's an exciting event, we were obviously very disappointed it didn't work out this year, but delighted to have it coming next year.” In the same article, Michael Dearth, the owner of Baduzzi in Wynyard Quarter described it as “fantastic news” and Brett Sweetman, general manager of the Park Hyatt Hotel in the Wynyard Quarter reported that “guests had already booked for the event.”

Business news – exciting openings, milestone birthdays and major awards

It’s been another busy quarter, with a suite of new hospitality businesses opening, including BBQ Chicken, Paskatsu, Koiya and Mizu Bread.

Auckland’s newest five-star hotel – SkyCity’s Horizon has opened as well. The New Zealand Herald’s Anne Gibson described the 303-room hotel as "visually stunning" with Warren and Mahoney, Moller Architects and Furnz Group pulling out all the stops to create a modernist masterpiece.

Two local hospitality institutions – Annette and Michael Dearth’s The Grove and Sid Sahrawat and Chandni Saharwat’s Cassia – have recently celebrated their 20th and 10th birthdays in the city centre respectively.

Murray Crane’s Crane Brothers has reached 25 years of business in the city centre. To celebrate, the sartorial stalwart has recommitted to their High Street lease and completed an extensive renovation of their store.

Congratulations to all of the teams past and present – we love to see the continued confidence in the city centre,

Finally, a massive congratulations to The Hotel Britomart, which was awarded the Best Hotel Award at the Hospitality New Zealand Business for Excellence 2024.

A summary of our insights for the June 2024 quarter is available here.

Previous quarterly results are available here.